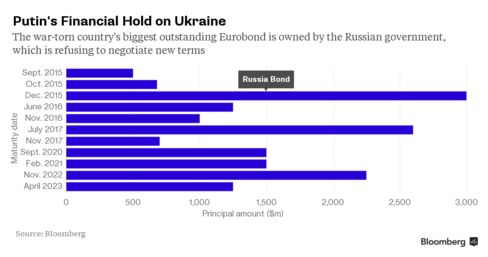

Russia stepped up pressure on Ukraine to pay back its $3 billion bond due in December by threatening to challenge an International Monetary Fund bailout loan if payment isn’t made.

“We will turn to the relevant judicial bodies” if Ukraine fails to make the payment in full, Finance Minister Anton Siluanov told reporters in Moscow on Monday. “Also, we are members of the IMF and we will question the validity of the IMF program to Ukraine.” Russia won’t negotiate with Ukraine on the debt, he said.

Ukraine wants Russia to accept a deal struck last month with creditors led by Franklin Templeton that included a maturity extension and 20 percent principal writedown. The restructuring is part of a $17.5 billion IMF loan aimed at easing pressure on Ukraine’s economy, battered by a conflict with pro-Russian insurgents in the country’s east.

“If Ukraine doesn’t pay in December, Russia will try to veto the IMF program, which would make the program continuation complicated,” Vadim Khramov an economist at Bank of America Merrill Lynch, said by phone from London. “The IMF has a good relationship with Russia and would probably prefer to choose a path of cooperation.”

Ukraine President Petro Poroshenko said on Sunday that Russia will “get no privileges” over private creditors and Finance Minister Natalie Jaresko said in August that paying the bond in full was “not an option.”

Russia has said the Eurobond should be treated as official state debt, rather than a tradeable bond. This classification is important because IMF policy prohibits lending to countries that are in arrears to official creditors.

The preliminary view by staff at the crisis lender is that the bond should be regarded as official debt, a person familiar with the matter told Bloomberg in June. IMF Managing Director Christine Lagarde said during a visit to Kiev on Sunday that the fund’s executive board will make the final call.