National savings marginally improved while the investment dropped to reduce the saving-investment gap to -0.6 per cent in 2015-16.

The September issue of the Monetary Policy Compendium issued by the State Bank of Pakistan (SBP) said the investment fell to 15.2pc of gross domestic product (GDP) in FY16 from 15.5pc in 2014-15.

According to the SBP report, national savings improved by just 0.1pc to 14.6pc in 2015-16 compared to 14.5pc in the preceding year.

Pakistan has the lowest savings as a percentage of its GDP in the region, excluding Afghanistan. This hampered economic growth that is not even 6pc, which is generally considered the base level to create enough jobs to absorb new entrants to the workforce every year.

The SBP did not release domestic savings as a percentage of GDP for 2015-16 and 2014-15, which is believed to be much lower than national savings.

Domestic savings are measured by excluding the external input like remittances that amounted to about $20 billion in the last fiscal year.

The same report showed domestic savings for 2013-14 at 7.5pc while national savings amounted to 12.9pc per cent in the same year.

This means domestic savings contributed 58pc to national savings while the rest of 42pc belonged to external factors in 2013-14.

Economists believe increasing domestic savings, which were about 15pc of GDP in the beginning of the first decade, is imperative for economic growth while reducing reliance on uncertain external factors like remittances.

The investment in 2015-16 was 15.2pc of GDP compared to 15.5pc in the preceding fiscal year. The SBP report shows the gross fixed investment fell to 13.6pc in 2015-16 from 13.9pc a year before.

The private-sector investment also fell to 9.8pc in 2015-16 from 10.2pc of GDP in the preceding fiscal year.

Though the investment dropped in 2015-16, the government has set an even higher target of 17.7pc for the current fiscal year.

The private-sector investment target was higher than what was actually achieved in the last fiscal year. For 2016-17, however, the private-sector investment target rose to 12.2pc from 9.8pc in 2015-16.

Similarly, the government has also set a higher target for national savings for 2016-17, which is 16.2pc of GDP. It was 14.6pc in 2015-16. It means the government wants to increase savings by 1.6pc of GDP, which looks like a tall order.

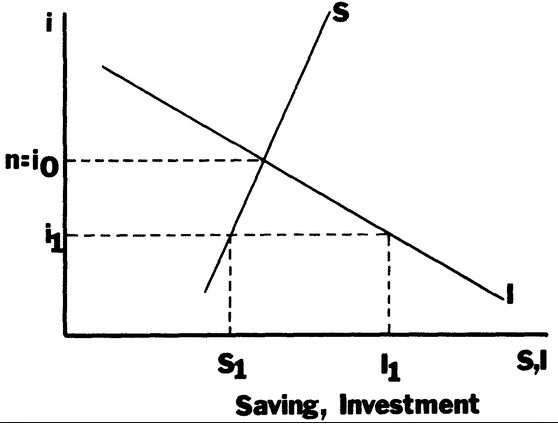

The saving-investment gap target for 2016-17 is -1.5pc, which means a higher investment and lower savings. The gap is just -0.6pc for 2015-16.

Pakistan’s saving rates are lower than most regional countries, as it has been struggling for the last eight years to improve its economic growth rate.

According to a report, the five-year average saving rate in India, Bangladesh and Sri Lanka was 31.9pc, 29.7pc and 24.5pc, respectively.

Add comment