The global bond rout intensified, the dollar strengthened and futures indicated U.S. equities will build on their biggest weekly jump in two years as investors further assess the implications of Donald Trump’s election to the American presidency. Japanese shares rallied after GDP data.

Sovereign bonds in Asia slid with U.S. Treasuries, extending a record debt selloff, amid speculation Trump’s plans to boost infrastructure spending will spur U.S. interest-rate hikes as economic growth and inflation pick up. Bloomberg’s dollar index climbed to a nine-month high as an earthquake weighed on New Zealand’s dollar and gold sank to a five-month low. The Topix index rose to its highest since April after Japan’s gross domestic product grew by more than economists forecast, while emerging-market assets slumped.

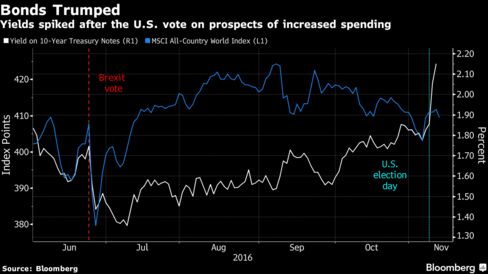

Trump’s election victory continues to send shockwaves through global markets, having already led to $1.2 trillion being wiped off the value of bonds worldwide last week as equities added about $1 trillion and industrial metals soared by the most in four years. At the same time, assets in developing nations are tumbling amid concern their exports will be hit by the prospect of more protectionist trade policies and monetary tightening in the U.S.

“Yields will continue to rise over the next year,” said Hiroki Shimazu, an economist and strategist at the Japanese unit of MCP Asset Management in Tokyo. “The fundamentals are very strong, particularly in the U.S. There are some signs of higher inflation pressures. Trump is pushing this phenomenon. ”

Stocks beat bonds by 4.8 percentage points last week, based on the MSCI World Index of equities in developed nations and the Bloomberg Barclays Global Aggregate Index. It was the biggest outperformance since December 2011.

Bonds

Ten-year U.S. Treasury yields increased by four basis points to 2.19 percent as of 11:47 a.m. Tokyo time, the highest since early January. They surged 37 basis points last week, the most in three years, amid speculation fiscal stimulus planned by Trump will widen the budget deficit and stoke inflation.

Federal Reserve Vice Chairman Stanley Fischer said Friday that the central bank was close to achieving its goals of maximum employment and price stability, strengthening the case for an interest-rate increase. Pacific Investment Management Co. said the Fed may raise borrowing costs three times by the end of 2017, while futures traders see an 84 percent chance of a hike at the central bank’s December policy meeting.

“The Federal Reserve now face the conundrum of rising inflation expectations,” Chris Weston, chief market strategist in Melbourne at IG Ltd., said in an e-mail to clients. “What we saw last week was a genuine change in the thought process of many money managers, with some feeling we need to be prepared for inflation, while many others have been truly skeptical of the moves and note that while markets are firmly in the ‘hope’ phase there are great execution risks.”

Government debt extended losses in Asia, pushing benchmark bond yields in Australia, New Zealand and South Korea to their highest levels since at least April. China’s 10-year notes dropped for a seventh day, the longest losing streak in three years.

Currencies

The Bloomberg Dollar Spot Index climbed 0.3 percent. The euro fell versus the greenback for a sixth day, its longest run of declines in six months, and the yen sank as much as 0.9 percent to its weakest level since early June. Japan’s economy expanded by an annualized 2.2 percent in the last quarter, exceeding the 0.8 percent expansion forecast in a Bloomberg survey and easing pressure on the Bank of Japan to add stimulus.

“The dollar is strengthening along with the rise in U.S. yields, reflecting expectations for economic expansion from fiscal spending,” said Yunosuke Ikeda, Nomura Holdings Inc.’s head of Japan foreign-exchange research in Tokyo. “Japan’s 2 percent growth can be used as a reason for the BOJ not lowering interest rates for a while.”

The kiwi dropped as much as 0.9 percent to a one-month low after a massive earthquake rocked New Zealand early Monday, killing two people and causing widespread damage. China’s yuan slid to its weakest level in six years.

Stocks

S&P 500 Index futures rose 0.4 percent, pointing to further gains after the underlying benchmark had its biggest weekly jump in two years.

Japan’s Topix index climbed 1.4 percent, while benchmarks in Hong Kong, Indonesia and Singapore slid to their lowest levels in more than three months. Markets in India are closed for a holiday.

The Shanghai Composite Index rose to a 10-month high after a raft of Chinese economic data, while a gauge of the nation’s shares in Hong Kong fell to a three-month low. Industrial production rose 6.1 percent from a year earlier in October, compared with a median estimate of 6.2 percent in a Bloomberg survey, and retail sales climbed 10 percent. Fixed-asset investment increased 8.3 percent in the first 10 months of the year.

New Zealand’s S&P/NZX 50 Index added 0.5 percent, led by a 4 percent jump in construction company Fletcher Building Ltd. following the earthquake.

Add comment