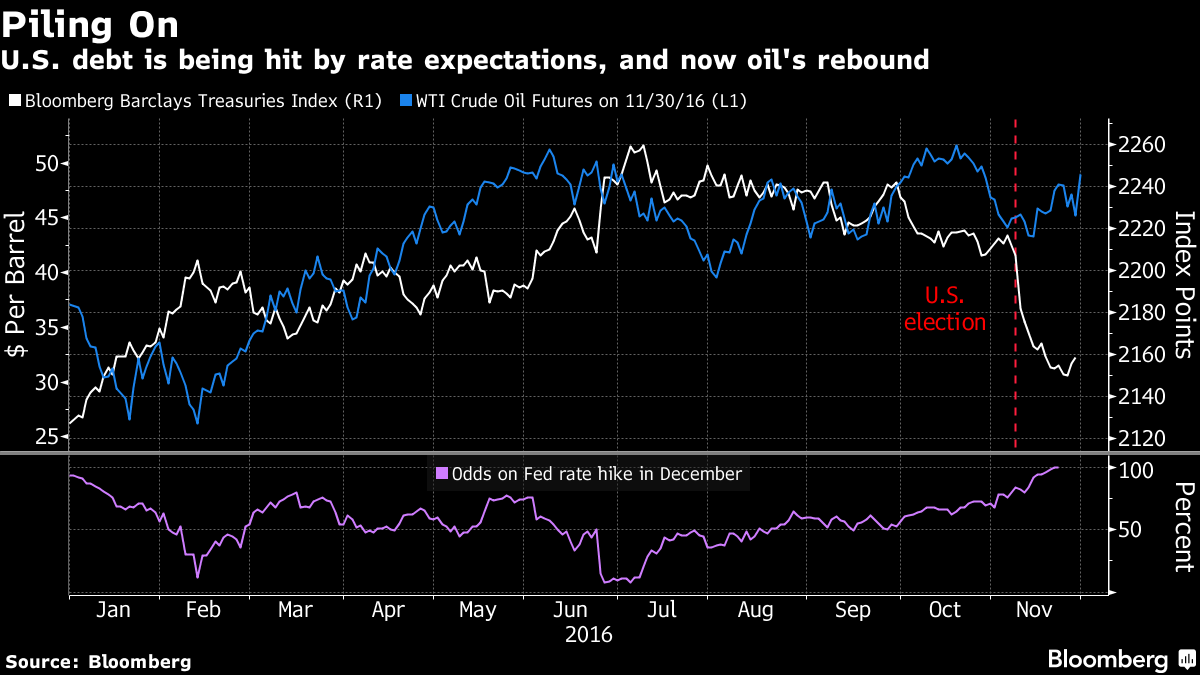

Asian equities rallied the most in three weeks as a deal to cut global oil output lifted energy shares, while evidence of strength in the U.S. economy sank bonds.

The oil deal, which until Wednesday’s meeting seemed in peril, provided further support for so-called reflation trades after Donald Trump’s election as U.S. president added to expectations for fiscal stimulus and Federal Reserve rate increases. Friday’s official U.S. payrolls data is the next focal point, after ADP Research Institute reported the biggest increase in private-sector workers since June. China’s official factory gauge came in Thursday at 51.7, above the 51 reading expected by economists, as smokestack industries regained momentum.

“The reflation trade continues to work in earnest, this time Trump has taken a back seat and OPEC and Russia have taken the initiative and lit the fuse under the oil price,” Chris Weston, chief markets strategist in IG Ltd. in Melbourne, said in an e-mail to clients. “We have once again seen that the dollar is the place to be.”

Stocks

- The MSCI Asia Pacific Index added 0.8 percent as of 12:18 p.m. Tokyo time, the most since Nov. 10, as a sub-gauge of energy stocks jumped 4.4 percent.

- Japan’s Topix index returned to its highest level since January, rallying 0.9 percent, while Hong Kong’s Hang Seng Index was up 0.6 percent and the Jakarta Composite Index was up 0.9 percent.

- Australia’s S&P/ASX 200 Index rose 1.1 percent, snapping a three-day drop as New Zealand’s S&P/NZX 50 Index climbed 0.5 percent, while the Kospi in Seoul was 0.2 percent higher.

- Futures on the S&P 500 Index were 0.1 percent higher, after the underlying benchmark slipped 0.3 percent Wednesday, trimming its November gain to 3.4 percent, still the best monthly performance since July.

Commodities

- West Texas Intermediate crude rose 1 percent to $49.96 a barrel and traded as high as $50.01 after surging 9.3 percent last session, the biggest one-day gain since Feb. 12. It ended November up 5.5 percent.

- The OPEC-led deal was broader than many people had expected, given that it extended beyond the bloc with Russia agreeing to unprecedented cuts to its own output.

-

Gold rebounded 0.2 percent, after sliding 1.3 percent last session to its lowest level since February.

Currencies

- The yen gained 0.3 percent to 114.07 per dollar, after touching its weakest point since March 10. The euro strengthened 0.2 percent to $1.0608.

- Bloomberg’s Dollar Spot Index, which tracks the greenback against 10 major peers, slid 0.2 percent after advancing 0.5 percent Wednesday, leaving it up 3.9 percent in November, the most since September 2014.

- “The failure of U.S. 10-year Treasury yields to get through 2.40 percent will likely cap the dollar ahead of payrolls and the Italian referendum,” said David Forrester, a strategist at Credit Agricole SA’s corporate and investment-banking unit in Hong Kong.

- The yuan dropped 0.1 percent onshore, reflecting dollar strength, and gained 0.2 percent offshore amid strengthening factory gauges and a crackdown on capital flows.

- Malaysia’s ringgit — which typically moves in line with oil prices given the country is Asia’s only major net crude exporter — was little changed as the dollar’s revival canceled out gains from the OPEC deal. The rupiah lost 0.1 percent.

Bonds

- Yields on Australian bonds due in a decade rose a third day, climbing seven basis points to 2.80 percent, while those in New Zealand advanced 11 basis points. Japan’s benchmark yield was 2 basis points and has closed above zero since mid-November.

- Ten-year Treasury notes yielded 2.38 percent after surging nine basis points Wednesday to their highest close since July last year. It jumped 56 basis points last month.

- Private payrolls in the U.S. climbed by 216,000 this month, after a 119,000 gain in October that was revised lower, ADP data showed Wednesday. Economists are predicting an 180,000-worker increase in nonfarm payrolls in Friday’s data, after they climbed by 161,000 in October.

- The Bloomberg Barclays Global Aggregate Total Return Index of bonds fell 4 percent in November, biggest decline since index started in 1990.

- “A lot of people are beginning to think that it is the end of the bull rally,” said Roger Bridges, the chief global strategist for interest rates and currencies in Sydney at Nikko Asset Management’s Australia unit

Add comment