Asian stocks extended the last session’s retreat from a 14-month high, while haven assets including the yen and sovereign bonds rose as investors weighed prospects of major oil producers agreeing output curbs at talks this week. Crude rebounded following its steepest drop in two months.

About three shares fell for every one that advanced on the MSCI Asia Pacific Index, while futures foreshadowed declines in U.S. and U.K. equities. Oil recouped about a quarter of the Friday’s slump amid indications Saudi Arabia will agree to cut output to January levels when OPEC members and Russia meet Wednesday in Algiers. The yen was the best performer among major currencies, while Turkey’s lira led losses in emerging markets after Moody’s Investors Service cut the nation’s credit rating to junk.

Friday’s plunge in oil prices knocked investor sentiment, which had been improving after central bank meetings in the U.S. and Japan bolstered expectations that monetary policies will remain loose. Federal Reserve rhetoric also muddied the waters in the last trading session as Dallas Fed President Robert Kaplan said the monetary authority “can afford to be patient in removing accommodation” and his counterpart in Boston saying a strategy of gradual interest-rate increases is prudent.

Bank of Japan Governor Haruhiko Kuroda is scheduled to speak Monday in Osaka after the central bank tweaked its approach to stimulus last week, switching the focus to controlling bond yields. European Central Bank President Mario Draghi will be addressing lawmakers in the European Parliament, while in the U.S. regional Fed chiefs for Dallas and Minneapolis are due to make speeches. The U.S. also has coming the first of three televised debates between presidential candidates Hillary Clinton and Donald Trump.

Stocks

The MSCI Asia Pacific Index was down 0.6 percent as of 11:08 a.m. Tokyo time, after gaining 3.6 percent last week.

Currencies

The lira sank as much as 0.9 percent to a seven-week low versus the dollar after Moody’s cut Turkey’s sovereign rating to Ba1 from Baa3 on Friday, citing risks related to the country’s external financing needs and a weakening of credit fundamentals. The decision marked the end of a review following an unsuccessful coup attempt in July.

The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, declined 0.1 percent on Monday following a 0.6 percent loss last week. The yen strengthened 0.2 percent.

New Zealand’s dollar fell to its low for the month after data showed the nation’s trade deficit widened by more than economists forecast in August.

Bonds

Australian government debt due in a decade rose for a third session, pushing their yield down by three basis points to 1.97 percent. Rates on similar-maturity New Zealand bonds fell for a fourth day.

Ten-year Treasuries were little changed after their yield slid seven basis points last week to 1.62 percent. The Fed refrained from hiking interest rates on Sept. 21 and lowered its projections for the number of increases in 2017 and beyond.

Commodities

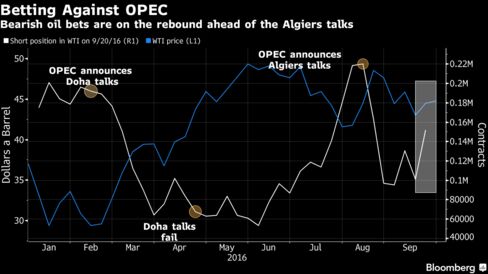

Crude oil added 0.9 percent to $44.85 a barrel. Saudi Arabia, the world’s No. 1 oil exporter, has offered tocut crude production to January levels, Algerian Energy Minister Noureddine Boutarfa said ahead of Wednesday’s meeting. The Saudis pumped a record 10.69 million barrels a day in August, compared with 10.2 million in January, and Boutarfa said Algeria wants major producers to cut their collective output by 1 million barrels a day.

Gold fell 0.1 percent, after climbing 2.1 percent last week. The precious metal’s price swings may become more severe in the final quarter owing to the U.S. presidential election and an expected interest-rate increase by the Fed, according to Citigroup Inc.

Nickel declined as much as 1.1 percent, retreating from a one-month high. Investors are awaiting the result of an environmental audit in the Philippines, which may close mines in the world’s largest supplier.

Add comment