Asian stocks rallied for a sixth day, South Korea’s won strengthened and regional bonds rose after central banks including the Federal Reserve signaled monetary policies will remain accommodative.

Raw-materials producers were the biggest gainers on an MSCI index of Asian shares outside of Japan, where markets are shut for a holiday. The S&P 500 Index advanced on Wednesday as the Fed left rates unchanged and scaled back its projections for hikes in 2017 and beyond. The won jumped the most since June as the dollar held losses from the last session. New Zealand’s currency weakened and its 10-year bonds surged by the most since June after its central bank said further policy easing will be needed. Crude oil gained following an unexpected slide in U.S. stockpiles.

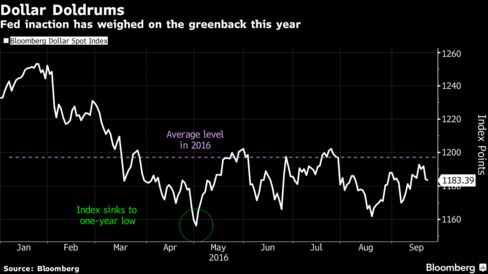

Loose monetary policies in the U.S., Europe and Asia have helped power gains in stocks, bonds and commodities this year and the latest signals from central bankers suggest the era of cheap money has further to run. While the Fed still sees a rate hike this year, its projection for increases next year was trimmed to two from three. Japan’s central bank on Wednesday pledged to overshoot its 2 percent inflation goal and took steps to limit the negative side effects of its record stimulus. Indonesia’s central bank is forecast to lower interest rates on Thursday, and some economists see scope for a cut in Norway as well.

The period “of having very low developed market rates for a very long time, and investors needing yields, that is still there,” Peter Kinsella, head of emerging market economic and foreign-exchange research at Commerzbank AG, told Bloomberg TV in Hong Kong. “We had previously thought it was going to be an aggressive Fed rate hiking cycle and it’s clearly not going to be that.”

Stocks

The MSCI Asia Pacific excluding Japan Index was up 1.3 percent as of 10:20 a.m. Hong Kong time. The city’s Hang Seng Index climbed 1.4 percent and the Hang Seng China Enterprises Index rallied 2.1 percent, the region’s biggest gains.

Futures on the S&P 500 Index declined 0.1 percent after the underlying gauge climbed 1.1 percent in the last session. Contracts on the FTSE 100 Index added 0.3 percent.

The Japanese central bank’s policy tweaks give it scope to keep easing to revive the economy and inflation, while limiting the negative impact on bank earnings.

The ringgit strengthened 0.5 percent, the most in two weeks, as the pickup in oil prices brightened prospects for Malaysia, Asia’s only major net exporter of crude.

Bonds

New Zealand’s 10-year bonds climbed 1 percent, pushing their yield down by 11 basis points to 2.50 percent. The Reserve Bank of New Zealand kept its key interest rate at a record low on Thursday and said further reductions will be needed in order to move inflation toward its 2 percent target. Investors increased bets on a November rate cut, with the probability of a move by then rising by 18 percentage points to 69 percent in the swaps market.

“The RBNZ Statement, although little changed from August, was slightly more dovish than the market anticipated,” said Jason Wong, a currency strategist in Wellington at Bank of New Zealand Ltd. .

Ten-year bond yields in Australia and South Korea dropped by seven basis points to 2.06 percent and 1.53 percent, respectively. The rate on similar-maturity U.S. Treasuries fell four basis points on Wednesday to 1.65 percent.

Commodities

Crude oil for delivery in November rose 1 percent to $45.79 a barrel in New York, after rallying 2.9 percent in the last session. U.S. inventories fell by 6.2 million barrels last week, official data showed Wednesday, spurring optimism a glut will ease. OPEC members Saudi Arabia and Iran, whose rivalry derailed an oil supply accord earlier this year, held talks in Vienna a week before the organization and Russia meet Sept. 28 in Algeria to discuss measures to stabilize prices.

Nickel climbed 1.7 percent in London, leading gains among industrial metals. Aluminum and zinc rose 1 percent.

Add comment