Oil held below $46 a barrel ahead of a make-or-break OPEC meeting on stabilizing the crude market, as gains in Asian property shares outweighed losses among commodity producers. The dollar headed for its steepest monthly advance since May.

Crude bounced off a two-week low reached Tuesday, when 10 hours of talks failed to resolve differences between oil-producing nations ahead of Wednesday’s formal meeting in Vienna. Japan’s Topix index rose toward its steepest two-month surge this year, fueled by the yen’s biggest slump since 2009. Equities also advanced in South Korea and Singapore. The New Zealand dollar and China’s yuan led currency gains in Asia, while the Bloomberg Dollar Spot Index was little changed. Industrial metals rebounded after slumping on Tuesday.

“The oil market is unlikely to be impressed by any token, face-saving agreement from OPEC,” said Ric Spooner, chief market analyst in Sydney at CMC Markets. “The substantial increase in OPEC production over recent months will leave the market in a surplus position for some time unless it can agree on significant production cuts. Momentum continues to fade in a wide range of markets, including stocks, bonds, currencies and base metals”

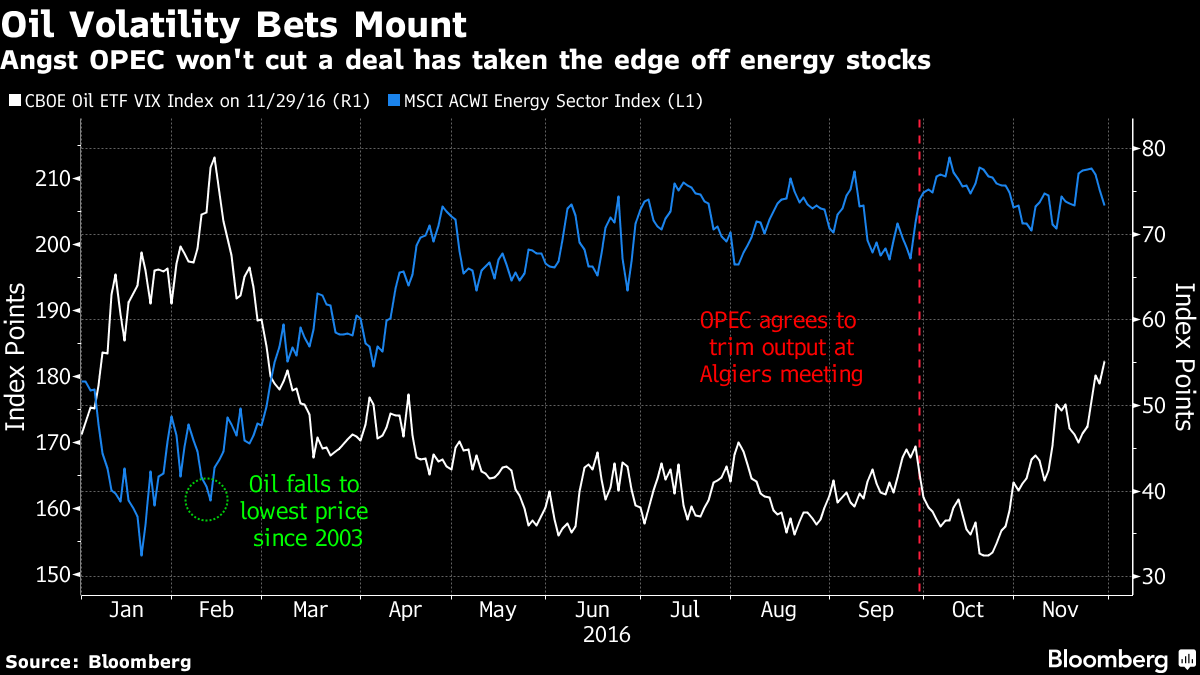

With the market giving just 30 percent odds to an agreement to end the oil supply glut, according to Goldman Sachs Group Inc., pessimism regarding the OPEC talks is helping quell a commodities rally sparked by Donald Trump’s surprise presidential victory. Investors are retreating from some of November’s standout trades as the month comes to a close, with the dollar faltering near a decade high that had been reached as Trump’s win fueled bets on higher interest rates. The monthly U.S. payrolls report is due Friday, after data Tuesday showed growth last quarter beat forecasts.

Australia unexpectedly reported its steepest year-on-year drop in building approvals since 2011, while Japan’s weaker industrial output data was in line with estimates. Thailand issues data on trade and manufacturing output later Wednesday, and Sri Lankan updates on consumer prices. Markets in the Philippines are closed for holidays.

Commodities

- WTI crude futures added 0.4 percent to $45.43 a barrel as of 11:27 a.m. in Tokyo, paring back from Tuesday’s 3.9 percent tumble to trim their November decline to 3 percent.

- Iran has vowed not to cut output, while Saudi Arabia said it is ready to reject an agreement unless all OPEC members — excluding Libya and Nigeria — take part, people familiar with the kingdom’s position said.

- Copper and nickel each jumped 0.8 percent while zinc bounced 2 percent after all three metals declined last session.

- Gold for immediate delivery gained 0.4 percent to $1,193.53 an ounce; that’s still down 6.6 percent since Oct. 31, poised for its worst month since November of 2015.

Stocks

- The MSCI Asia Pacific Index added 0.5 percent as the Topix rose 0.2 percent, while the Kospi in Seoul jumped at least 0.4 percent with the benchmark in Singapore.

- Technology shares and telecommunications service providers were the biggest gainers in the region, with each group rising about 1 percent, while materials companies slid 0.8 percent.

- Australia’s S&P/ASX 200 Index fell 0.3 percent, with sub-gauges of raw materials producers and energy stocks down at least 1.5 percent.

- Futures on the S&P 500 Index were little changed after the underlying benchmark rose 0.1 percent to 2,204.66 on Tuesday.

Currencies

- Bloomberg’s dollar gauge, which tracks the greenback against 10 major peers, lost less than 0.1 percent; it has retreated about 0.7 percent since Nov. 24, after hitting a decade high last week.

- The kiwi and the renminbi rose by at least 0.2 percent, paring their declines in the month.

- One-month forwards on Russia’s ruble retreated 0.3 percent.

- The yen was little changed at 112.38 per dollar after dropping 0.4 percent on Tuesday.

Add comment