The government has withdrawn the cash subsidy on fertiliser sales, which was offered to the industry in the budget for fiscal year 2016-17 to provide support to the manufacturers, farmers and the overall agricultural sector.

However, it has not ended the General Sales Tax (GST) subsidy that amounts close to Rs184 per 50kg bag of urea.

“Under the subsidy programme, sales tax had been reduced from 17% to 5%, estimated at Rs184 per bag of urea,” said an official of the Ministry of National Food Security and Research while talking to The Express Tribune.

Overall, the government had announced a urea subsidy of Rs390 per bag including cash subsidy of Rs156, GST subsidy of Rs184 and price reduction of Rs50 by the manufacturers.

The price of urea had gone down from Rs1,790 to Rs1,400 per bag following the announcement of the subsidy.

Now, a notification has been issued to end the cash subsidy of Rs156 per bag. “No, notification has been issued to withdraw the GST subsidy,” the official said, adding the fertiliser manufacturers would themselves decide whether to continue the Rs50 price cut, which they had been offering since the budget.

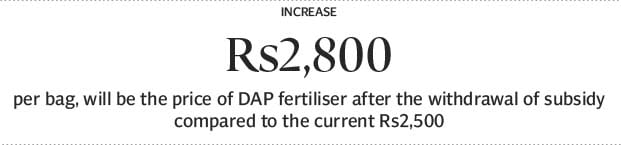

The government has also withdrawn the cash subsidy of Rs300 per bag on sales of di-ammonium phosphate (DAP) fertiliser. Now, the DAP price will rise from Rs2,500 to Rs2,800 per bag.

According to an industry official, fertiliser manufacturers have not yet decided whether to increase prices after the withdrawal of cash subsidy. “They will meet on Thursday to take a decision in this regard,” he said.

When asked for comments, a fertiliser company official said, “We are currently analysing the situation and a decision will be reached in the next few days. As of now, the prices remain the same.”

The food ministry official pointed out that farmers were relying more on urea and any increase in its price would have an impact on the sowing of crops.

He, however, was of the view that the government could have announced an increase in the subsidy but no proposal could be discussed so far as the Ministry of Finance did not back any rise in the subsidy than what was announced in the budget, fearing it may widen the budget deficit.

The agricultural sector is already suffering and withdrawal of the cash subsidy will exacerbate its problems. In fiscal year 2015-16, the performance of the agricultural sector, as a whole, remained dismal as it recorded a negative growth of 0.19% against expansion of 2.53% a year earlier.

An analyst of Topline Securities research house said in a report the reversal of cash subsidy would have a marginal impact on urea demand from the farmers. “However, if the subsidised GST rate of 5% is reversed to the earlier 17%, it can have around Rs390 per bag pass-on effect on the urea prices.”

The analyst pointed out that imported urea would be a threat for the time being as prices in the global market were on the rising trend and stood at around Rs1,920 per bag.

Criticising the withdrawal of subsidy, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) Executive Committee Member Fehmida Jamali said farmers were already suffering from the absence of appropriate policies and the fresh move would further hit them.

“I don’t see any logic why the [food] ministry has discontinued this subsidy with immediate effect,” she said.

Jamali emphasised that the agricultural sector was the foundation of Pakistan’s economy, however, its share in the total national output and its capacity to drive growth and development were diminishing. “In the last eight years, average agricultural growth has been 2.1%,” she said.

Add comment