Stocks in Asia rose at the start of a busy week that includes a meeting between Xi Jinping and Donald Trump and culminates in the monthly U.S. jobs report.

Stocks from South Korea to Indonesia gained, after the best quarter for the region’s equities in five years. Japanese shares fluctuated after a report showed an improving outlook among the countries’ largest firms. The dollar weakened after New York Federal Reserve President William Dudley said there’s no rush to raise interest rates. The euro rose. Markets in China and Taiwan are closed for holidays. Oil edged lower after last week’s biggest gain of the year.

As the second quarter gets going, political developments threaten to cloud the improving global economic outlook. The first major data release showed confidence among Japan’s large manufacturers improved for a second consecutive quarter in the first three months of the year.

The dollar was struggling for upward momentum even before Dudley’s dovish comments Friday, and despite last month’s Fed rate hike, on concern Trump may struggle to steer his promised tax cuts through Congress. A Bloomberg gauge of the currency recently hit a four-month low.

What investors will be watching this week:

- The RBA is projected to keep rates steady Tuesday. Australian trade data due before may give guidance to the debate between the need to restrain currency strength and damping runaway east-coast property prices.

- India’s central bank will probably also hold rates. Inflation numbers are due from Thailand, South Korea and the Philippines.

- Fed speakers include Dudley and Governor Daniel Tarullo. Minutes from the March meeting should put their comments into perspective. Minutes are also due from the European Central Bank’s latest gathering.

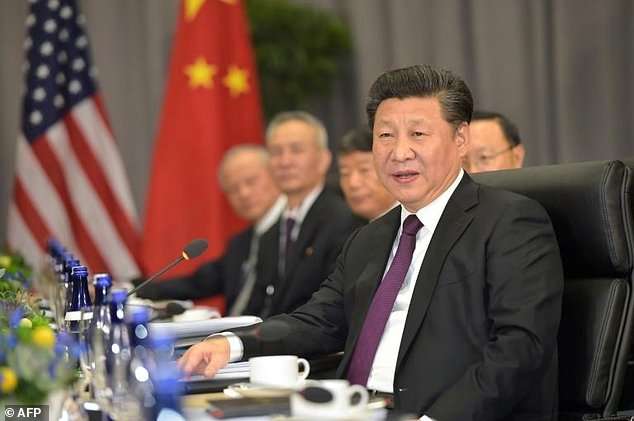

- China’s President Xi Jinping will meet U.S. President Donald Trump.

- U.S. non-farm payrolls are due Friday.

Here are the main moves in markets:

Stocks

- The MSCI Asia Pacific Index gained 0.2 percent, after soaring 8.8 percent in the first quarter, the best performance since 2012.

- The Topix index gave up some of the morning’s 0.5 percent gain and was up 0.1 percent at 1:23 p.m. in Tokyo. Hong Kong’s Hang Seng was up 0.3 percent. South Korea’s Kospi and Singapore’s Straits Times Index were also up 0.3 percent, and Jakarta’s Composite climbed 0.7 percent. Australia’s S&P/ASX 200 Index fell 0.3 percent.

- Futures on the S&P 500 were little changed after losing 0.2 percent on Friday. The Stoxx Europe 600 Index rose 0.2 percent.

Currencies

- The yen was up less than 0.1 percent at 111.35 per dollar as most major Asian currencies gained. The Korean won led the charge, rising 0.5 percent, building on its more than 7 percent advance in the first quarter.

- The euro rose 0.2 percent to $1.0677. The Australian dollar fell 0.3 percent. The Bloomberg Dollar index was down less than 0.1 percent.

Bonds

- The yield on 10-year Treasuries rose less than one basis point to 2.40, after dropping three basis points Friday.

Commodities

- WTI crude was down 0.2 percent at $50.51 a barrel, after the biggest weekly gain of the year. Crude stockpiles are starting to decline in a sign that the production cuts implemented this year are bringing the market to balance, according to OPEC’s Secretary-General Mohammad Barkindo.

- Gold was flat at $1,248.20 per ounce. The metal has alternated between gains and losses for the past six days.

Add comment