DESPITE NOT BEING THERE IN THE VISION OR MISSION STATEMENT, THE WORD ON THE STREET ABOUT “NIT” IS “BAILOUTS” AND “FROZEN SHARES”

Vision Statement

Be the leading Asset Management Company of Pakistan and the catalyst for good governance, responsible investor relations and economic development.

Mission Statement

To provide competitive investment products across asset classes to a diverse set of retail and institutional customers with a view of maximizing Shareholders and Unit-holders returns. Protect our investors’ rights through effective board representation and provide exemplary investor service through investment in technology and human resources.

A number of national level institutions like Islamabad Policy Institute and Society of Technical Analysts Association of Pakistan have requested the Board of NIT, SECP’s Policy Board, and Ministry of Finance to immediately address the issue of Frozen Shares.

The Market Participants and a large number of individuals who stand invested in the NIT are concerned that substantial Management Fee is still being charged on the Frozen Shares which is deeply against the interest of the investing public at large.

The main benchmark index of Pakistan Stock Exchange has been migrated onto Free Float Methodology which means “the chunk of shares which are readily available for trade”—however, it is NOT SO in the case of the SNGP and PSO shares, as a large chunk of these two scrip are not readily available for trading. Hence, the questions raised in terms of consistency and integrity of KSE-100 are plausible.

Investor Interest Protection and an absence of level-playing field are other issues in context of Frozen Shares which continue to disturb and shake the confidence of an ordinary investor.

The players of the market who understand and know the history and genealogy of NIT and Frozen Shares appear to have far larger and far superior benefits over those, who just don’t know the matter. All they know, is the word TRUST which they have in NIT as a national institution. The players who know the intrinsic value and value proposition of NIUT in context of bullish spell and NIT’s inability to sell the frozen, benefit by way of ‘redeeming and benefiting’ at the of those who remained ‘loyal and invested.

NIT which was founded in 1962 as an open end fund, continue to enjoy the support and active participation of an ordinary man on the street.

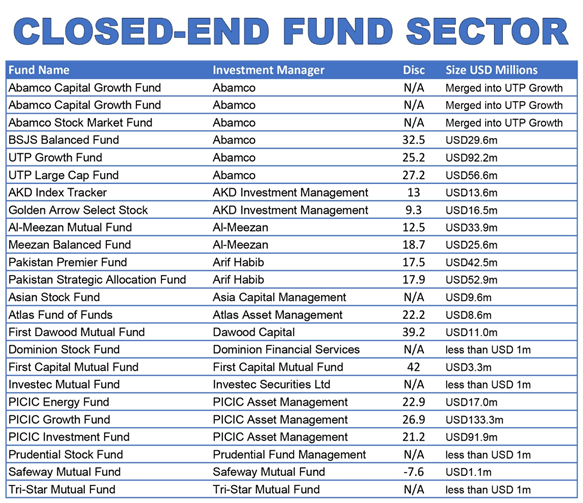

NIT HISTORY In 1966, the Investment Corporation of Pakistan was established and launched a number of closed-end funds. In 2002, there was a significant development in the closed-end fund sector with the privatization process of the Investment Corporation of Pakistan (ICP) initiated by the government. In addition to the privatization process of the ICP, there have been a number of other closed-end funds launched by the above two companies and a number of other private fund management companies. Reorganization in the sector continues In 2005, Arif Habib announced plans to open-end the Pakistan Capital Market Fund. It is understood that the Fund Management Company decided to do this without pressure from shareholders. The open-ending was completed by the end of 2005 after receiving approval from the SECP. This was the first case in Pakistan that a closed-end fund converted to an open-end Fund. In 2006, ABAMCO announced the planned merger of the ABAMCO Capital, ABAMCO Stock Market and ABAMCO Growth Fund into the UTP Growth Fund.

Fund sizes updates as of August 31st, 2006, PKR/USD exchange rate 60.42

UTP Growth Fund was formerly called Abamco Composite Fund

Funds with AUM below USD1million are not tracked.

Source: COL Research, Bloomberg.

The three ABAMCO funds mentioned above and the PICIC Investment Fund and PICIC Growth Fund hold “Frozen Holdings”. These shares were previously held in the portfolios of the ICP Funds and were transferred with the management rights of the funds. These “frozen shares” can only be sold to strategic buyers through the government of Pakistan. However, if the Pakistan government is able to sell its stake in the privatization process, these shares can be sold as part of that process. The price is expected to be at a price above that in the market. The “frozen holdings” are in National Refinery (NRL), Pakistan State Oil (PSO), and Sui Northern Gas Pipelines (SNGP)

In the year 2010, the management of NITL transferred the portfolio of NI(U)T-LOC holders Fund, worth about 23 billion to its four unit holders in order to settle the long-standing issue of LOC issued by the Government of Pakistan. In 2010, the Ministry of Finance (Finance Division) assured that the long-standing matter of frozen portion of PSO and SNGPL shall be resolved as addressed “SHORTLY” through a third-party agreement amongst NIT, NBO and Privatization Commission, which to-date remains unsettled.

The Islamabad policy institute and Society of Technical Analysts Association of Pakistan have stressed upon the Ministry of Finance, Government of Pakistan to remove the anomaly of Frozen Shares in the case of PSO and SNGPL, they further demanded:

- Until the resolution or unfreezing of these shares, the number of free float shares of these two stocks should be adjusted and reduced from the daily sum values of KSE-100 Index

- NIT should stop charging Management Fee immediately on the frozen shares

- The Investors, who remained invested since 2006 should be compensated.

Mr. Tariq Iqbal Khan, the Chairman of the Audit Oversight Board said that the matter of “FROZEN SHARES” is against the interests of Unit Holders of NIUT and these shares should be unfrozen at the earliest.

Add comment