The Liquidity, Leverage and Losses are the 3 big L’s which continue to haunt the small investors of the struggling Pakistani Capital Market.

Liquidity: Our Economic capacity utilization is too low and our whimsical desire to catch-up with India is at the heart of many problems which are faced by the masses at large. In terms of purchasing power parity India ranked third with a GDP of $9.6 Trillions in 2019 while Pakistan stood at 24th position. Low capacity utilization, enhanced unemployment due to cuts in development expenditures aren’t letting clean savings and grey-monies the Productive Concern which are ancillary to the creation of export-quality stuff having cascading effect at the forex reserves.

Leverage: Debt growth of any sustainable Economy must be in line with income growth, which is not so in case of Pakistan and aptly reflected at the main board of Pakistan Stock Exchange.

Losses, the word “losses” has somewhat become privy and proprietary to small investors of Pakistan, as all the Governments use PSX as a Dashboard Canvas to paint the gloomy picture of Economy. Ironically, Government cannot showcase the very few who make big gains at the cost of small investors and obviously cannot face the small investors, who rightly exclaim that present plight of Tax regime, Policy Rates and Forex Fluctuations are grossly favorable to few, rather than large quantum of society.

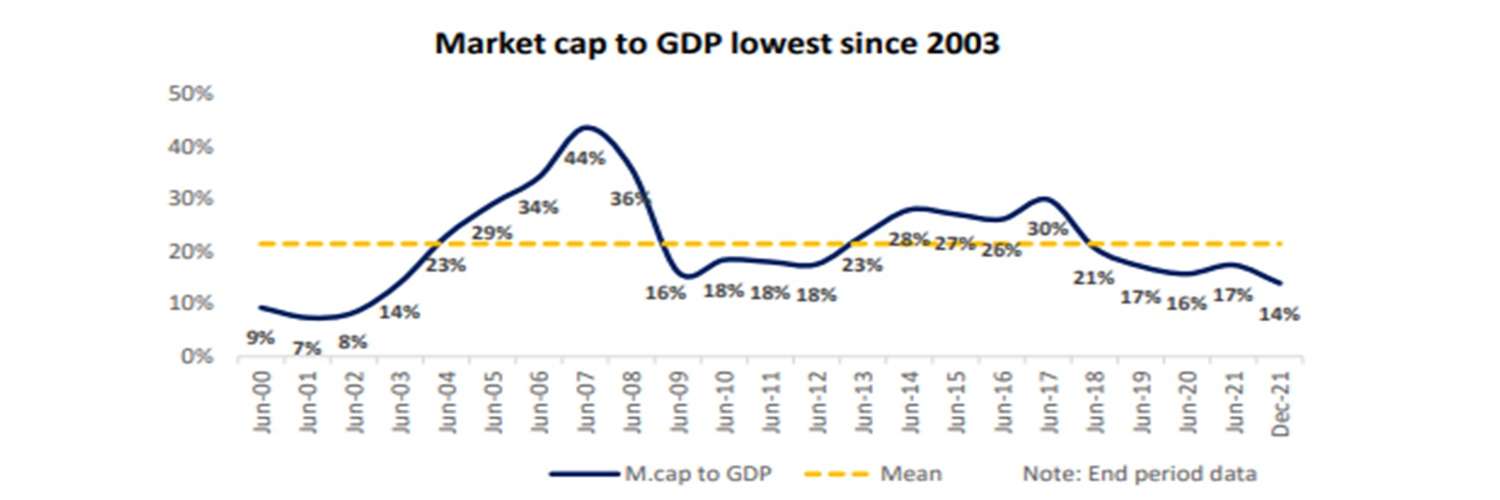

The KSE-100 Index has missed the targets / forecasts of the 7 leading brokerage first with consistency and since past 5 years, median index target for KSE100 by key research houses has ranged from 45,000-55,000. However, the market has failed to achieve the expected target in every single year. The median index target for 2022 also seems to be in the similar range despite earnings base moving up by 118% (Bloomberg KSE100 earnings index at 8,523 in 2021 vs 3,893 in 2017), which shows market’s lower conviction in re-rating theme for Pakistan in the near term. This does not necessarily mean that index target expectations were inaccurate instead this illustrate that other factors are overshadowing companies’ fundamentals, particularly lack of liquidity (both foreign and local). The market is undervalued by all means but the gap between fair value and market values might persist until structural deficiencies are overcome mainly i) increase in PSX investor base, ii) end of boom-bust cycles, iii) more stock market listings and products offering, and iv) parity in documentation requirements between different asset classes (especially real estate).

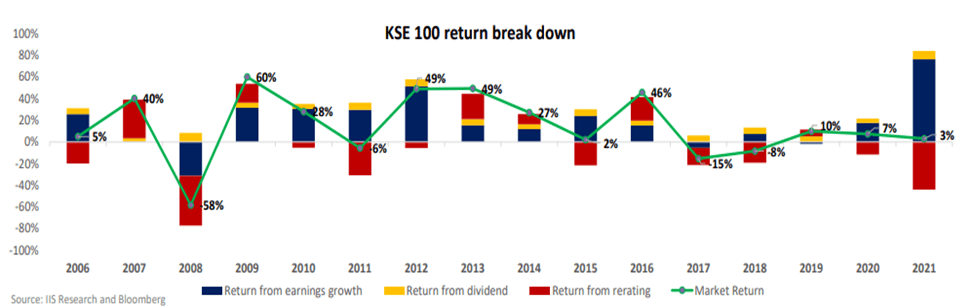

Many Brokers spoke of re-ratings of the Stock Market in the past, but a hefty de-rating of the market was seen in place. The KSE 100 benchmark index returned meagre 2% in PKR terms whereas the return in USD was -8% in CY21. In contrast, 32 stock markets (MSCI DM/EM/FM markets) reached all-time highs in 2021. The record-breaking trend was not just limited to developed markets like America, Canada or Australia, but Frontier and Emerging markets like Sri Lanka, Vietnam, Bangladesh, and India also accomplished this feat.

Ismail Iqbal Securities has set an Index target of 55,000 without the prospects of re-ratings.:

“In absence of a major liquidity gush, we see index growth to solely come from earnings growth of 14% and dividend yield of 9%. We have not assumed any P/E re-rating. We link major re-rating to structural reforms i.e., end of boom-bust cycles, economic policy consistency, increase in stock market depth/investor base, and bringing documentation requirement of other asset classes (especially real estate) at parity with PSX. If re-rating happens, we highlight that 1x increase in the P/E would add approx. 10,000 points to the index target. It may sound absurd but if the index reverts to its mean valuation multiples or the discount to MSCI EM/FM reverts to mean, the index target would be over 80,000”

Time will tell, as to whether the bellwether index of PSX lends an ear to IIS call!!!

Add comment