European stocks climbed with U.S. equity-index futures and the yen retreated after a two-day global equity selloff drove demand for havens. Concern that the slowdown in China may crimp global growth sent Asian shares lower.

Standard & Poor’s 500 Index futures rose after a 3 percent rout on Tuesday, while the Stoxx Europe 600 Index also climbed. The MSCI Asia Pacific Index fell amid the wildest gyrations in more than two years. China’s benchmark index closed little changed, paring a drop of 4.7 percent, before holidays to mark the end of World War II. Malaysia’s ringgit plunged as oil dropped below $45 a barrel in New York.

“You have worries about the global growth outlook, led by Chinese concerns, at a time when the Fed is thinking about raising interest rates,” said Shane Oliver, a global strategist at AMP Capital Investors Ltd. in Sydney, which oversees about $114 billion. “That’s leaving investors very twitchy.”

‘Growth Scare’

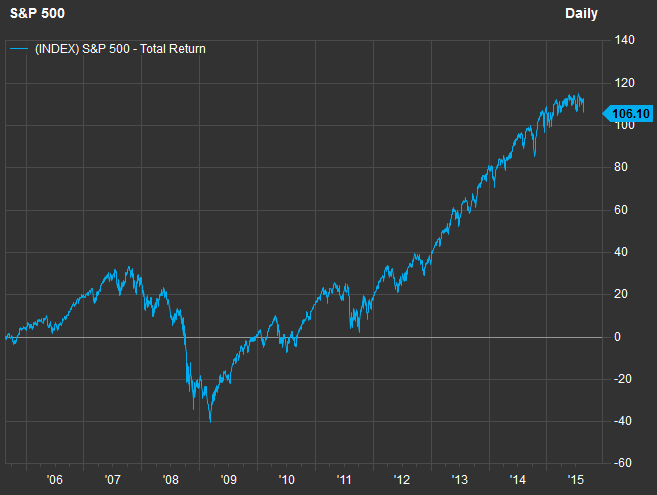

S&P 500 futures rallied 0.9 percent by 8:12 a.m. in London after the gauge capped its third-biggest decline of 2015 on Tuesday. It was a sour start to September, historically the worst month of the year with the equity gauge falling 1.1 percent on average going back to 1927, according to data compiled by Bloomberg.

European stocks rose after the Stoxx 600 slid 2.7 percent Tuesday. The gauge, whose 8.5 percent August drop was the biggest since 2011, added 0.7 percent. Healthcare companies led gains Wednesday, while materials producers and banks fell the most over the last month among the 19 industry groups in the measure. The euro weakened 0.5 percent to $1.1259.

The MSCI Asia Pacific Index dropped 0.7 percent, swinging from a loss of 1.1 percent to a gain of 0.4 percent before sliding again. A measure of 30-day historic volatility climbed to the highest since mid-2013. The Markit iTraxx Asia index of credit default swaps climbed two basis points to 140 basis points, the highest since March 20, 2014.

“This shows risk-off markets in general amid a global growth scare, which has led to further emerging market outflows,” said Daniel Chan, a Hong Kong-based money manager at Rays Capital Partners Ltd. “In such an environment, investors tend to ditch risky assets for safe havens.”

Australia’s S&P/ASX 200 Index erased a drop to finish little changed, while the so-called Aussie added 0.2 percent after earlier weakening to as few as 69.82 U.S. cents, a level not seen since 2009. Second-quarter gross domestic product advanced 0.2 percent from the first three months of the year, when it rose 0.9 percent, government data showed Wednesday. That compared with the median of 27 estimates for a 0.4 percent gain.

China Stocks

A gauge of Chinese shares in Hong Kong dropped 1.6 percent, while the Shanghai Composite Index fell 0.2 percent at the close.

China’s benchmark stock measure earlier erased a retreat of as much as 4.7 percent as traders tested how far authorities will go to prop up the market. The benchmark index closed near its highest level of the day for the fifth straight session amid speculation state-backed funds are using afternoon share purchases to boost prices before a victory parade.

Japan’s Topix swung between gains and losses at least 10 times as the yen dropped 0.6 percent against the dollar. Japan’s currency weakened against all of its 16 major peers as a measure of exchange-rate volatility rose to a five-month high. The yen surged Tuesday as the global equity rout and slowing global growth clouded the outlook for the Fed to raise interest rates as early as this month.

West Texas Intermediate crude slipped 1.9 percent to $44.56 a barrel, the second straight decline. Energy analysts are predicting a 900,000-barrel jump in U.S. supplies in a report due Wednesday. Brent in London retreated 1.4 percent to $48.88 a barrel.

Malaysia’s ringgit dropped 1.1 percent to 4.2125 per dollar as lower oil prices compounded selling pressure from the political crisis dogging Prime Minister Najib Razak. The FTSE Bursa Malaysia KLCI Index dropped 1 percent.