The market is skeptic about today’s Monetary Policy Committee meeting. On Fri Jan 21, 2022, a number of treasury officials were found chasing a government paper with 60 days maturity @ 10.35%, this is probably the stage which was setup by a soft tug-of-war between the Finance Minister and Governor, SBP

Market expectation about an increase of 50 basis points in the policy rate is not a cause of concern, as the market has discounted that much of change by observing a dwindling performance during the week ending on Jan 21, 2022. The increase of 50 basis points in the policy rate shall have a great fallout over the business and prospects of employment in the country.

Inside Financial Market expects the rupee to make some gains, MPC to act rationally and avoid increasing policy rate by 50 basis points, and market to remain calm until Jan 28

The Business Community has been in the mode of condemning the idea of increasing the policy rates, a number of businessmen question the very logic and mindset behind increasing the policy, immediately, after concluding the TERF. While a vast majority is willing to trust the words of the SBP Governor, a large lot questions the integrity and independence of MPC, as to whether, should the MPC give any weight to the opinion which are explicitly expressed in the media by the Governor, SBP.

Mian Zahid Hussain who is a stout, outspoken critique of the Government’s economic policies has asked the Government to rather reduce the policy rate.

The central banks ask the commercial banks to add a provision of bad debt against the loans extended to state of Pakistan, only “so-virgin” and independent institution like “SBP” could dare do that.

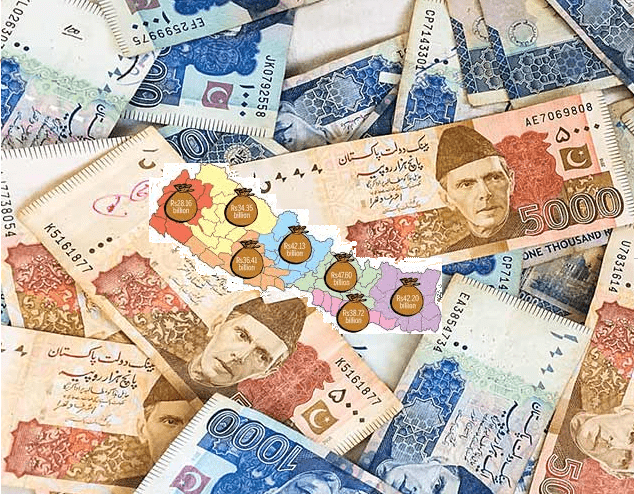

One of the structural issues hindering the development of the economy and state is the distribution of economic resources. The present government has started a debate that the country must consider the Presidential form of Government. The debate about the presidential system is also said to be instigated by the old lords of Bureaucracy in the aftermath of 18th Amendment that has enhanced the Provincial share in the divisible pool to 57.5%, leaving very little for the Bureaucracy, the management of which costs around 5 trillion PKR annually.

Talks about the Presidential form of Government are futile debates and as such Pakistan does not need any change in the present form of Government, Mian Zahid Hussain.

The shrinking piece of cake is cause of concern for the hikers of Margalla hills, they are concerned that lest the situation is handled, their might come a day, that the “sword of rightsizing, cutting expenses and shunning pensions” is fallen on them. Now the intellects at the center, want the cake to be bigger so that talks about “snug palatial abodes and majestic lifestyle” are limited to provincial capitals and there are no talks about cuts in administrative costs at the center.

Pakistan is now a day observing an inflationary growth model, whereby it has become more dependent upon tax collection from import of goods, and the state has misfortunately an unsustainable route of printing notes and extending credit to the elites under the name of TERF—temporary economic refinance facility.

One of the worrisome aspects which came out during the discussion with Mian Zahid Hussain was the large-scale-Economic mismanagement, shirking-share of manufacturing segment in the GDP, shortage of electricity, water, and gas for the Industry.

The challenges of Income inequalities are to be taken seriously, investments in the manufacturing units have to take place, the trend of increasing the interests rate has to end, speculating model of the economy is to be discouraged, and real estate is to be brought into the tax net.

Mian Zahid Hussain asked Imran Khan to pay special attention on the revival of sick units like PIA, Pakistan Steel and other white elephants which were taking a tool @ 1.5 billion dollar per month.

Ignorance of Karachi will deepen the Economic challenges at the national front. The government gets 68% of its revenue from Karachi, while its share in exports is 54% and Karachi’s share in textile exports is around 52% which cannot be ignored.

Mian Zahid Hussain, a strong support of PTI is vocal about untoward government policies about Karachi. While expressing his concern about the deteriorating situation of an ordinary man on the street in Karachi told Mr. Sanie Khan that the investors are not able to fulfil their commitments on time due to the gas crisis which is affecting their reputation and the situation becomes erratic when businesses have to pay fines, time and again, as and when, they fail to meet their business commitments.

Mian Zahid Husain cited the cases of closure of Industries due gas shortages which had started to take tole on over the unemployment numbers, he hoped that PTI government would soon develop a strategy to iron-out the differences between the center and provincial government. He reminded the last year’s agreement between industrialists of Karachi and the Ministry of Energy + Ministry of Commerce and registered concerns that agreement had been heeded by the competent authorities which was a tantamount wholesale mockery businessmen, state and constitution of Pakistan.

Mian Zahid Hussain demanded the resolution of LNG issue which was causing losses worth billions to national exchequer, he concluded that depriving SINDH province of gas was unacceptable and termed the same a cruel act with an entity of federation which contributes 2/3rd of country’s gas.

Add comment