The dollar weakened versus all of its major peers and Asian stocks fell to a two-month low as a tightening race for the U.S. presidency deters risk-taking ahead of the Nov. 8 vote. U.S. equity index futures declined with the Mexican peso.

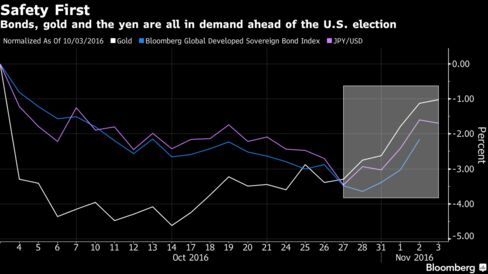

Bloomberg’s dollar index dropped for a fifth day, its longest losing streak in four months, amid concern the election’s fallout could kill off any prospect of the Federal Reserve raising interest rates next month. A gauge of expected price swings in global currencies rose to the highest in almost two months and Asian stocks slipped to a two-month low. Australia’s sovereign bonds rose and gold gained for a sixth day as investors favored haven assets. Copper retreated from its highest level since July and oil rose from a one-month low. Japan’s markets were shut for a holiday.

Investors turned more risk averse over the past week as polls suggested Hillary Clinton’s once dominant lead over Donald Trump was faltering ahead of next week’s election, with her prospects having dimmed as the Federal Bureau of Investigation reopened a probe into an unauthorized e-mail server she used while Secretary of State. Bets on a December interest-rate hike by the Federal Reserve were stepped up on after a policy meeting concluded Wednesday as the central bank signaled a December move is likely.

Clinton holds a slim advantage among independents, with almost half of voters in that crucial bloc saying renewed scrutiny of her e-mails won’t impact their decision. Likely voters who don’t identify with either party represented 29 percent of the electorate in the last presidential election and now back Clinton over Trump 39 percent to 35 percent in a head-to-head contest, the latest Purple Slice online poll for Bloomberg Politics shows.

Currencies

The Bloomberg Dollar Spot Index, which tracks the currency against 10 major peers, fell 0.2 percent as of 11:05 a.m. Hong Kong time. The yen strengthened 0.4 percent to a one-month high and South Korea’s won rebounded from a three-month low.

“Once we get over the event, typically, volatility will start to drop in a big way,” said Peter Chia, foreign-exchange strategist at United Overseas Bank Ltd. in Singapore. The election is “unlikely to start a new bearish dollar trend. The market will focus back to the Fed,” he said.

The Fed left rates on hold for a seventh consecutive meeting Wednesday and said in its statement it only needed “some” further evidence that inflation and employment were on track toward their goals before raising them. Futures contracts show a 78 percent likelihood of an increase in December, compared with 68 percent on Tuesday.

Mexico’s peso fell as much as 0.7 percent to its weakest level since September, reversing an earlier advance. The currency tends to fall when Trump’s prospects election prospects improve because of concern his policies would hurt trade and ties between Mexico and the U.S.

Stocks

The MSCI Asia Pacific excluding Japan Index fell 0.3 percent after dropping 1.4 percent on Wednesday, its steepest slide in a month. New Zealand’s benchmark stock index entered a correction, while Hong Kong’s Hang Seng Index fell to a 12-week low.

“The move to take risk off the table continues,” Chris Weston, chief market strategist in Melbourne at IG Ltd., said in an e-mail to clients. “We have reached a point where there is a buyers strike, where money managers have reduced their risk, increased cash allocations within the portfolio and are happy to ride out this mini-storm of uncertainty. This is a perfect breeding ground for short sellers who love the combination of uncertainty and lack of bids.”

Futures on the S&P 500 Index dropped 0.4 percent following a seventh day of losses in the U.S. benchmark, its longest selloff since November 2011. Nasdaq 100 Index contracts declined 0.6 percent after Facebook Inc. slid in extended New York trading after reporting earnings. The social network predicted an uptick in costs and a slowdown in advertising sales growth.

Commodities

Gold climbed 0.4 percent and was set to close above $1,300 an ounce for the first time in a month. Copper declined 0.4 percent in London and aluminum extended Wednesday’s retreat from its highest level since June 2015.

Crude oil was up 0.9 percent at $45.76 a barrel after tumbling 2.9 percent in the last session. U.S. inventories rose by 14.4 million barrels last week, the biggest gain in data going back to 1982 and more than the 2 million barrel increase forecast in a Bloomberg survey, official figures show. Record OPEC output last month is also damping the outlook for oil, complicating the group’s effort to stabilize prices.

Bonds

Australia’s 10-year bond yield fell six basis points to a one-week low of 2.29 percent. New Zealand’s declined by one basis point to 2.76 percent.

Add comment