The challenge: to create a resilient, accessible financial system that people trust.

Savings, investments and other financial products are essential for long-term economic growth and development. Whether running a household or a corporation, people need access to reliable, affordable financial services and these are what the global financial system should provide.

The global financial crisis shook both the financial system and the public’s confidence in it. In its wake, there has been closer scrutiny of the financial system and debate over the role regulation has to play and how extensive it should be. It is a debate that will help shape the future of the financial system along with other significant challenges such as enabling more inclusive growth and the effect technology is having on the way financial services can be delivered and used.

What impact has the financial crisis had?

The global financial crisis revealed significant weaknesses in the financial system and some of the vulnerabilities that can result from having such an interconnected global market.

Several years after the crisis, the world economy is still struggling with slow growth, unconventional monetary policy in major economies, and constrained government budgets. It is vital that we find ways of making the financial system more resilient and able to withstand shocks in the market.

The crisis also caused a significant drop in levels of public trust and confidence in financial institutions. To function efficiently, the system needs to re-establish that trust.

Why does the system need to change?

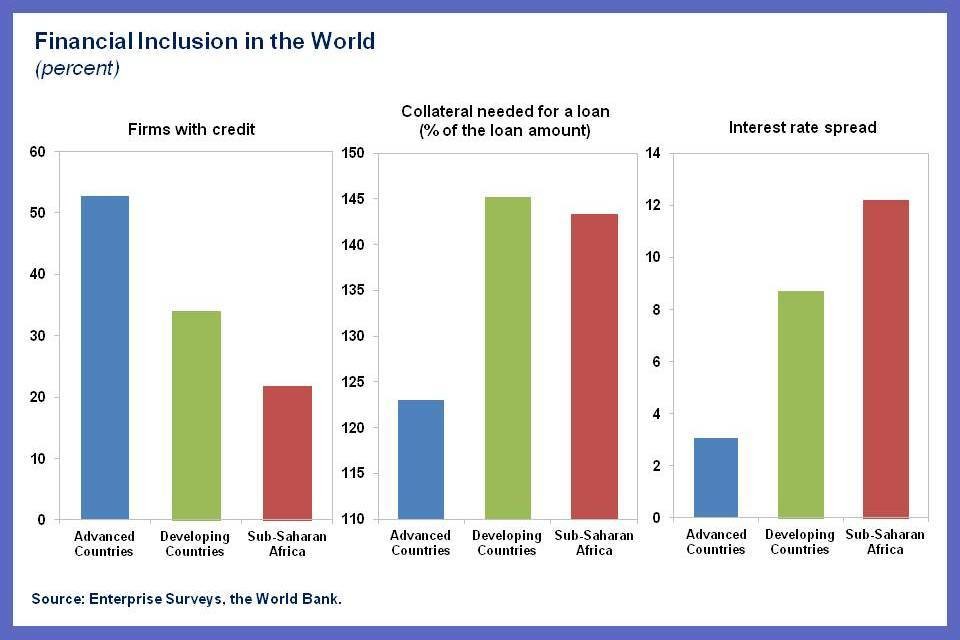

As well as restoring public trust and improving resilience, there is an urgent need to allow more people to access the financial system.

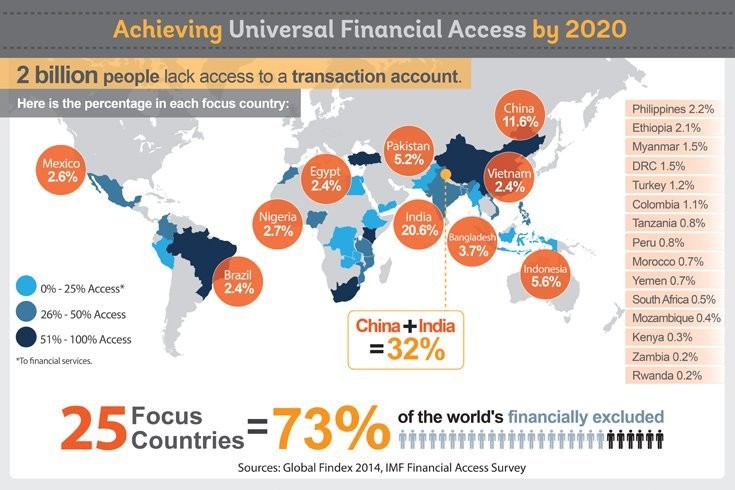

Providing access to credit and savings is a major challenge in the battle against global poverty—yet two billion people do not have access to high-quality, affordable financial services. Additionally, there are 200 million small and medium-sized enterprises worldwide that have no access to formal financial services.

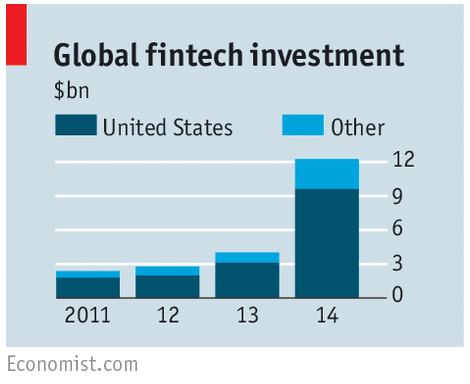

The gap is also being filled with companies who use technology to decrease cost and measure risk in new and innovative ways. These companies have created an entire new industry, often referred to as “fintech” (a contraction of “finance” and “technology”), defined as the use of technology and innovative business models in financial services.

What are the challenges of new technology?

Through their ability to adapt to the ever-changing financial environment, these new agile, tech-led companies are disrupting the financial services industry and making headway in providing alternative financing opportunities for small and medium sized enterprises.

From 2013 to 2014, equity investment in fintech companies quadrupled from $4 billion to more than $12 billion, fuelling innovation in the sector.

New players are redefining the way services are delivered and used, putting pressure on more established firms. Big companies that once relied on regulation and the size of their investment portfolios as a source of competitive advantage are realizing that these factors can actually hold them back in the current digital context.

Traditional banks will continue to play a large part in the financial services industry but fintech companies, with their ability to adapt quickly and use technology to lower costs and provide novel credit-analysis systems, are bringing rapid change.

The Forum is providing a platform for dialogue among top policy-makers, business executives and experts to build a common ground and test ideas and solutions on these major issues facing the financial system.

In 2016 the Forum will publish two global studies on financial inclusion in collaboration with the International Finance Corporation. In addition, the Forum is partnering with ministries of finance in various countries to accelerate financial inclusion as part of their national development strategies. Current country-level projects include Colombia, India, Indonesia and Mexico.

The Forum is working to establish a set of technology-related recommendations on the financial system that are applicable to both the public and private sectors, and has been working closely with the Financial Stability Board and Bank of England.