Prosecution and Legal Affairs Division (PLAD)—Securities and Exchange Commission of Pakistan, [email protected] 0800-88008.

On 2nd day of October 2020, the Securities and Exchange Commission of Pakistan has constituted a body in compliance of Right to Information Act 2017 and has nominated of Mr. Muzaffar Mirza under Section 9 of the same.

A number of bodies representing small investors have appreciated this move of the Commission and have hoped that the same would help swift disposal of complaints, litigation and belated Prosecutions in context of disclosure of information.

Right to information Act 2017 gives right each and every individual citizen to access information from the government and private bodies. The very principle of Right to Information (RTI) is based on premises that Information belongs to people.

RTI boosts transparency, strengthens accountability, and reduces corruption. While Lobby system governs ill-practices, blurs transparency, and denies the accountability which actually protects the loyalists and the lobbyists.

Proper Information Disclosure is one of the major impediments hindering the development of Pakistani Capital Market. While such a designation is timely and plausible, it is very much justifiable to expect that PLAD would look into the following information which greatly affects the transparency, volatility and liquidity of the market. Much of the information is either made available when its value has elapsed or is not made available at all.

MARGIN TRADING AND MARGIN FINANCING INFORMATION

- MTS Release Information: PSX present trading screen should also display the MTS release information on real-time basis, and should also separately display the new take-up and take-ups against MTS releases.

2. MFS Information: Likewise, MTS the MFS information should also be made available on the real-time basis at PSX Trading Screen.

3. Disclosure of top five Financier and Financees in a scrip: In the situation when the MTS and MFS open positions exceed by 10% of the free-float, then PSX should disclosed the names of top 10 financiers and finances of that Scrip

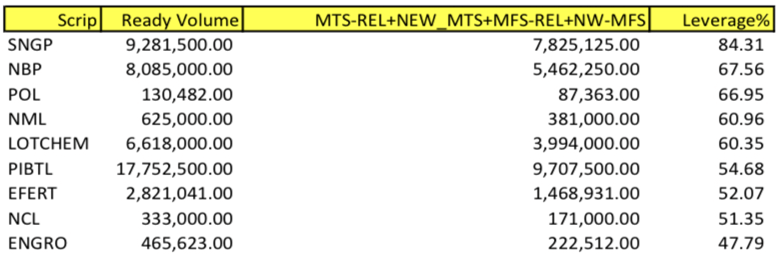

4. Leverage to turnover ratio: Reporting and disclosure of information as to how much a symbol is leveraged/overleveraged can help protect speculator’s interest which in turn secures investor’s interest confidence in the market. This information is not necessarily pretending the exacts settlement ratios which are always below 10% and huge amount is netted against speculative trades which is fantastic for the market. all we are saying is this “that is an information which is factual”, we are siding with badla providers or takers, movers and shakers who pump and dump using MTS and MFS..

- Net Blank Sale Position in DFC is to made available at the end of each day. This information becomes available on the next-day.

- Our Society shall be pursuing with NCCPL the disclosure of scrip wise FIPI/LIPI with NCCPL

Add comment