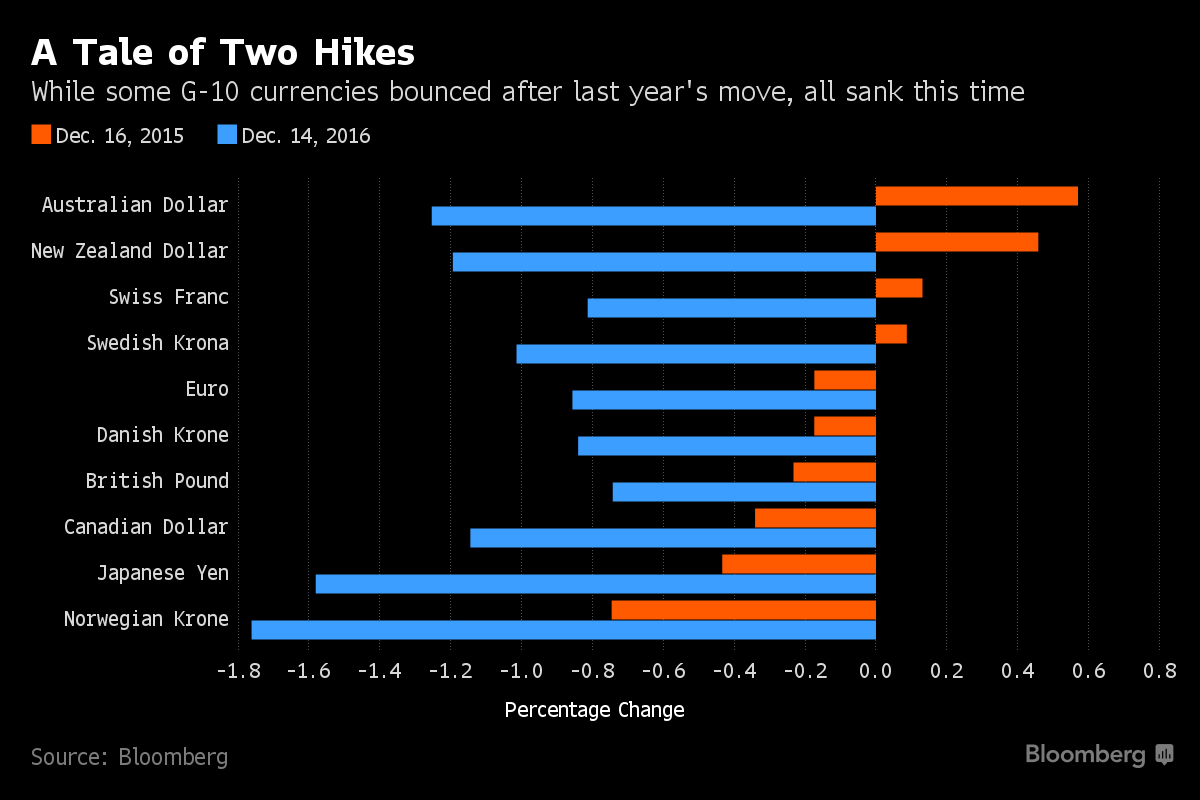

The dollar was the chief beneficiary of the Federal Reserve’s first and only interest-rate hike of 2016, rallying to a 10-month high against the yen after officials signaled a steeper path for borrowing costs. Asian stocks outside Japan slipped with bonds.

The greenback extended its advance against major and emerging-market peers, except for Australia’s dollar which rose after stronger-than-expected job gains. Equities in Australia, China and South Korea slid, declining with gold as the dollar’s strength weighed on crude oil for a second session. Government debt tracked a rout in Treasuries. The Korean won sank the most in a month, even as the central bank held rates, and China’s yuan fell the most in a month.

The second U.S. rate increase in a decade tied off a volatile year for markets, with investors initially whipsawed by ructions in Chinese trading, then the shock wins for Brexit and Donald Trump. The Fed moving further into tightening territory helps shift the focus away from global central-bank policy and toward fiscal stimulus, with Trump expected to stoke U.S. growth through spending. After hiking by 25 basis points, the Fed said it expects three rate increases in 2017, up from two in September. Speaking to reporters after the decision, Fed Chair Janet Yellen sought to downplay the significance of that shift.

“The fact that 11 of 17 voting members are calling for at least three rate hikes in 2017 reverberated around trading floors,” said Chris Weston, chief market strategist in Melbourne at IG Ltd. “Keep an eye on China as the strength of the dollar is not going to be welcomed by the Chinese corporates who have to borrow from debt markets to fund much of the recently announced acquisitions.”

Like Korea, Indonesia is projected to keep its key rate on hold in a policy review Thursday. Singapore updates on retail sales and Sri Lanka reports on gross domestic product, while the Philippines issues figures on remittances from overseas workers.

Currencies

- The yen fell another 0.2 percent to 117.31 per dollar as of 11:30 a.m. Tokyo time, extending losses and touching its weakest level since Feb. 4.

- The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, was little changed after Wednesday’s 1.1 percent jump. The euro fell 0.2 percent.

- The Fed lifted its target for overnight borrowing costs by 25 basis points, or 0.25 percentage point, on Wednesday to a range of 0.5 percent to 0.75 percent.

- “This is a very modest adjustment in the path of the federal funds rate,” Yellen said during the press conference. The decision to raise rates is “a vote of confidence in the economy,” she said, noting that some Fed officials, but not all, incorporated the assumption of a change in fiscal policies when making their forecasts.

- The won slipped as much as 1.1 percent, while the onshore yuan was down 0.4 percent after China’s central bank weakened its fixing by the most since August.

- Australia’s dollar gained 0.3 percent on better-than-expected jobs data.

Stocks

- The MSCI Asia Pacific Index sank 1.6 percent, the most since Nov. 9, even as exporters allowed Japan’s Topix index to trade little changed.

- Australia’s S&P/ASX 200 Index lost 1.1 percent as energy and mining stocks led declines, while the S&P/NZX 50 Index in Wellington was down 0.4 percent.

- The Kospi index in Seoul fell 0.4 percent; China’s CSI 300 Index slipped 0.6 percent.

- After the S&P 500 Index’s steepest drop since October on the back of the Fed’s decision, futures on the U.S. benchmark was little changed early Thursday.

Bonds

- Yields on 10-year Treasury notes were little changed after rising for five sessions, capped by a 10 basis point jump on Wednesday that took them to their highest level since September 2014.

- New Zealand bonds led declines in the region, with yields up 11 basis points to 3.39 percent, while those on similar maturity Australian debt increased eight basis points to 2.88 percent.

- Ten-year Japanese yields climbed three basis points to 0.08 percent.

Commodities

- West Texas Intermediate crude fell 0.4 percent to $50.85 a barrel, building on Wednesday’s 3.7 percent slide.

- Gold for immediate delivery was little changed at $1,143.25 an ounce, after sliding to its lowest price since February.

- “The FOMC was upbeat and more hawkish than anticipated,” strategists at Australia & New Zealand Banking Group Ltd. said in a note, referring to the rate-setting Federal Open Market Committee.

- Lead climbed 2 percent in London.

Add comment