The flight to haven assets eased following the biggest drop in the dollar since July with moves in the yen, Treasuries and gold steadying ahead of Donald Trump’s inauguration. Hong Kong shares rallied with emerging-markets assets.

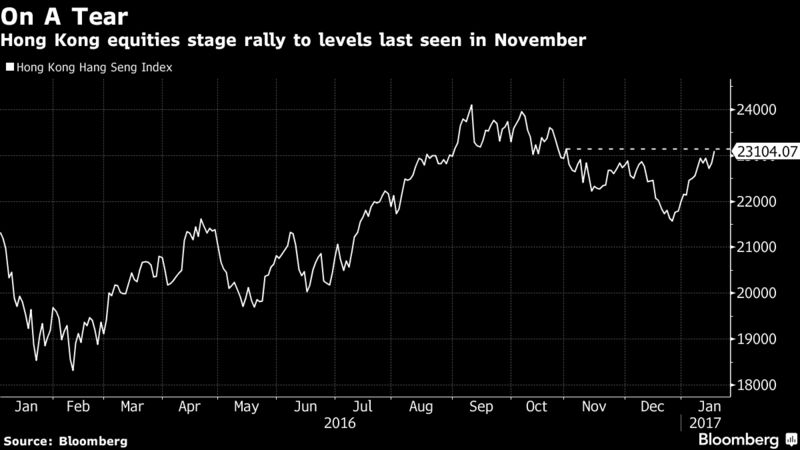

Gold and the yen fell for the first time in eight days. Chinese equities gained amid speculation of state efforts to ensure market stability during President Xi Jinping’s appearance at the World Economic Forum in Davos. Hong Kong’s Hang Seng continued its run to the highest level since the start of November. Tokyo shares sank with those in Sydney and Taipei, following losses on the S&P 500 index, while stocks in Jakarta and Manila rose.

Politics have impacted heavily on global markets in 2017 with traders assessing the significance of Trump’s comments that the dollar is too strong ahead of his inauguration on Friday. The U.S. currency rose after Federal Reserve San Francisco President John Williams said the U.S. economy has reached its maximum employment goal and gradual interest rate increases will likely be appropriate. Meanwhile, trading firms are reaping the rewards from stronger currencies and bond-trading in the wake of the U.S. election, with Morgan Stanley saying momentum from a strong fourth quarter continued into the first weeks of 2017.

“Trump has made a lot of announcements but people are waiting for that to translate into implementation and some policy around that,” Paul Harris, a Toronto-based fund manager at Avenue Investment Management, told Bloomberg TV. “This is the time when you might have some slight volatility.”

The Chicago Board Options Exchange Volatility Index rose 5.7 percent on Tuesday to the highest level of this year. A similar gauge for the Nikkei Stock Average slipped 0.2 percent on Wednesday after jumping 15 percent over the previous two days.

Stocks

- The MSCI Asia Pacific Index added 0.1 percent as of 12:18 p.m. in Tokyo. Australia’s S&P/ASX 200 fell 0.6 percent. The Hang Seng added 1.1 percent as property shares climbed. The Shanghai Composite advanced for a second day.

- Japan’s Topix lost 0.4 percent, declining for a third day.

- Futures on the S&P 500 rose 0.1 percent. The underlying gauge lost 0.3 percent on Tuesday.

- The Jakarta Stock Exchange Composite Index rose 0.4 percent as BlackRock says Indonesia remains most favored market due to its cyclical recovery.

Currencies

- The Bloomberg Dollar Spot Index added 0.2 percent after retreating 1.3 percent on Tuesday to the lowest in a month.

- The yen slid 0.4 percent to 113.04 per dollar, after soaring 3.9 percent over the previous seven days.

- The Aussie fell 0.3 percent to 75.44 U.S. cents. It’s had the best run among G-10 currencies since the start of the year, up 4.9 percent.

- The won climbed as much as 1 percent against the dollar, while the Malaysian ringgit advanced 0.4 percent.

- The pound retreated 0.6 percent to $1.2341 after surging 3.1 percent on Tuesday.

Commodities

- Gold lost 0.2 percent, snapping a seven-day winning streak that was the longest since November.

- Iron ore futures slid 1.3 percent, also ending a seven-day stretch of gains.

Add comment