Tire Manufacturers One Big Winner From the Collapse in Oil Prices

Tire Manufacturers One Big Winner From the Collapse in Oil Prices

Few industrial companies will celebrate the collapse in oil prices to below $50 a barrel more than the world’s largest tire manufacturers.

For firms including Bridgestone Corp., Michelin & Cie., Goodyear Tire & Rubber Co., Continental AG and Pirelli & C. SpA, lower energy prices not only mean cheaper synthetic rubber, but also higher demand as motorists drive more.

“We are at a type of sweet spot at the moment,” Continental Chief Financial Officer Wolfgang Schaefer told investors Aug.4 after announcing that second-quarter profit jumped 25 percent from a year ago.

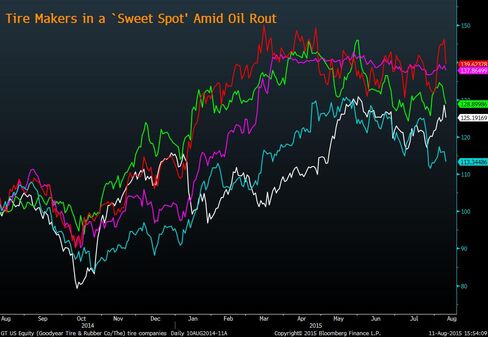

Investors appear to agree: the shares of the top-five tire producers have rallied since oil prices started to fall. Take Goodyear, the U.S. largest tire producer. Its shares are up 25 percent over the last year, while the S&P 500 index — weighed down by oil producers — is up 7.4 percent over the same period.

According to the Rubber Manufacturers Association, an industry body, it takes about seven gallons of oil to produce enough synthetic rubber to make a tire. The cost of Brent crude, a global benchmark, has fallen 51 percent over the last year to less than $50 a barrel.

“Tiremaker margins are expanding because of low prices for synthetic and natural rubber,” Kevin Tynan and Tanner Murphy, analysts at Bloomberg Intelligence, said in a report.

The industry’s gross margin rose to almost 27.5 percent in the first quarter, the highest in at least 15 years, according to data compiled by Bloomberg Intelligence.

Low oil prices have another indirect effect: cheaper gasoline and diesel mean that motorists are driving more often and farther away.

U.S. drivers have responded particularly strongly to lower fuel prices. In May — the latest data available — they traveled 275.1 billion miles, a record high and surpassing the peak set in August 2008, just before the global financial crisis spread, according to U.S. government data.

“We see miles driven being up,” Goodyear Chief Executive Officer Richard J. Kramer told investors July 29. “That means more tread rubber is being burned on the road.”

Add comment