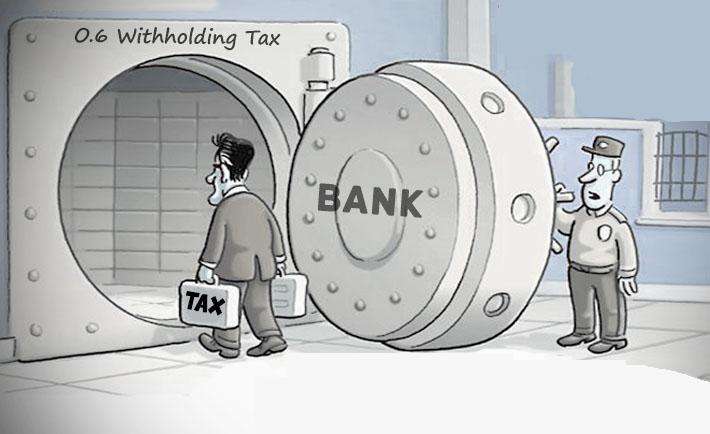

Federal Board of Revenue (FBR) Chairman Tariq Bajwa Monday said 0.6 percent withholding tax on banking transactions of non-filers would be restored from October 1, 2015 under Income Tax Laws (Amendment) Ordinance, 2015 and an incentive package is being finalised for traders to encourage documentation and voluntary tax compliance.

On the conclusion of the Public Accounts Committee meeting at the Parliament House here on Monday, Tariq Bajwa told Inside Financial Market that Income Tax Laws (Amendment) Ordinance, 2015 is very clear on the withholding tax rate on banking transactions of non-filers.

Under the Ordinance, the rate was reduced from 0.6% to 0.3% w.e.f. July 11, 2015. This reduced rate will remain effective till September 30, 2015.

The FBR will start collecting 0.6% on banking instruments of non-filers from October 1, 2015.

Responding to a query, FBR Chairman said that the government is finalising an incentive package for the traders” community to remove their difficulties in filing their income tax returns. The purpose of the package is to encourage documentation and provide an opportunity to the traders to voluntarily file their due returns. The FBR is taking steps to remove apprehensions of the traders in filing of returns and declarations of assets.

The focus of the whole exercise is to facilitate business community in becoming filer and thus avoid imposition of Withholding Tax under section 236P of Income Tax Ordinance, 2001, as well as to resolve related issues pertaining to Income Tax and to evolve an effective communication strategy on educating the public specifically traders on the rationale of this tax measure for documentation of economy and broadening the tax base, Tariq Bajwa added.

Earlier, the FBR Chairman informed the meeting that State Bank of Pakistan (SBP) has informed FBR that there is no dip in turnover or deposits of banks following imposition of tax on banking instruments of non-filers. The withholding tax on banking transactions is very important tax for documentation of the country. There is an increase of 33 percent in revenue collection during the last two years. Tax-to-GDP ratio has witnessed an increase from 8.4 percent to 9.5 percent during this period.

Chairman of the sub-committee of the PAC said that the withholding tax on non-filers of tax returns would result in cash transactions. People would prefer cash transactions instead of paying higher rate of withholding tax to the banks. Resultantly, there would be high rate of crimes like murders, robberies and burglary due to cash transactions, which will damage the social fiber, he added.

Add comment