Asian stocks rose amid optimism the global economy is strong enough to withstand higher U.S. interest rates. Brent oil traded near $49 a barrel after OPEC deferred a decision on production cuts, while Malaysia’s ringgit weakened for an 11th straight day.

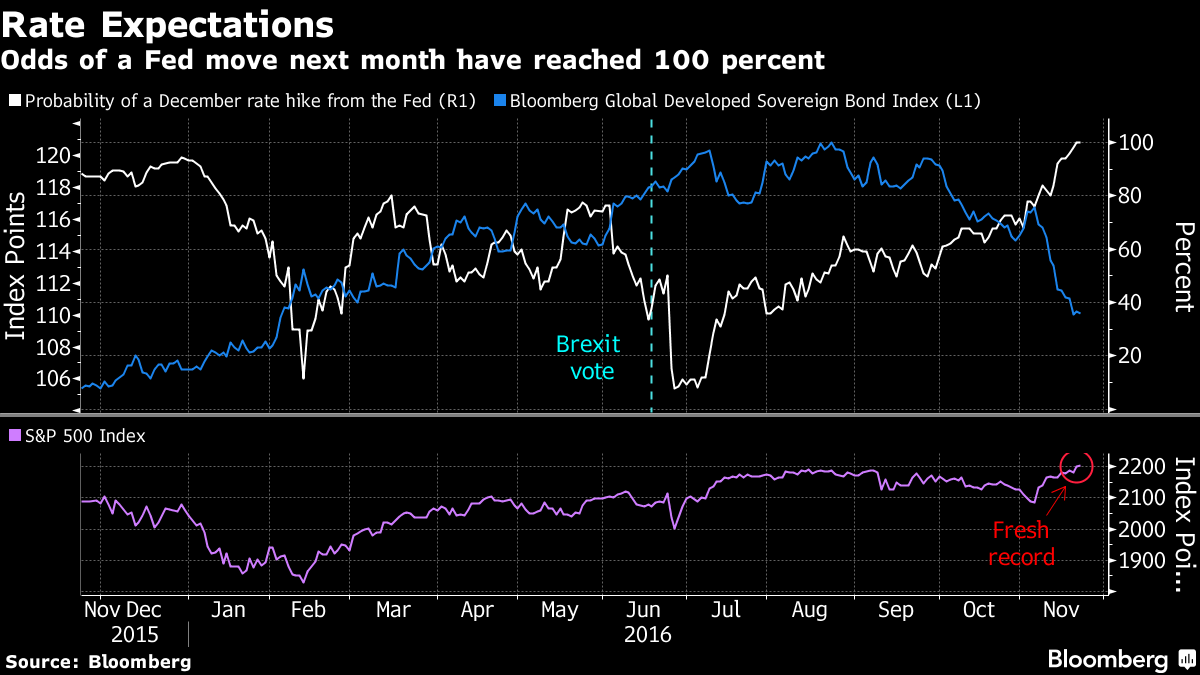

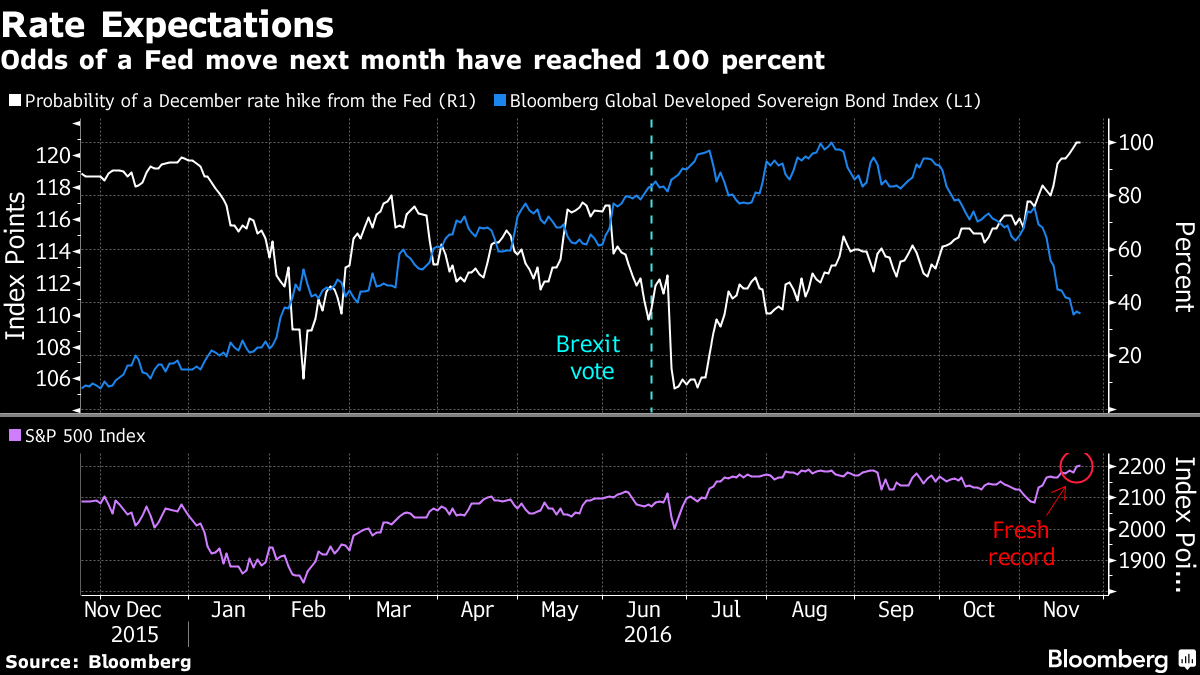

Chinese and Australian shares paced regional gains after U.S. equity indexes advanced to all-time highs. Government bond yields in Australia and New Zealand climbed as market-implied odds of a Federal Reserve rate hike in December held at 100 percent, while the ringgit slumped toward a 13-month low before a Malaysian central bank meeting on Wednesday. Oil fluctuated after OPEC left unresolved how Iran and Iraq will participate in planned output cuts.

The MSCI All-Country World Index headed for its third day of gains, the longest winning streak in two months, as equity traders took an optimistic stance before America’s Thanksgiving holiday on Thursday. Developed-market shares and the dollar have been among the biggest winners since Donald Trump’s surprise election victory fueled speculation of more fiscal stimulus, while government bonds and emerging markets have slumped. Traders will look for further confirmation of the Fed’s policy intentions when minutes from the central bank’s November meeting are released on Wednesday.

“Bulls have got control here and U.S. equity and many other developed markets are going higher, at least in the short term,” Chris Weston, chief markets analyst in Melbourne at IG Ltd., said in an e-mail. “The Fed has been guiding market participants to believe they always wanted a hike in December. They just needed a little more information before increasing rates and now they have more than enough information to convince them.”

Along with the Fed minutes, U.S. data on durable goods orders, jobless claims, home prices and manufacturing are due Wednesday. Malaysia is projected to keep interest rates on hold, while Singapore will release inflation figures for October.

Stocks

The MSCI Asia Pacific excluding Japan Index advanced 0.6 percent at 11 a.m. Hong Kong time, building on last session’s 1.1 percent increase. Raw-material and financial shares led gains.

The Hang Seng China Enterprises Index climbed 1.2 percent and Australia’s S&P/ASX 200 Index added 1 percent. Benchmark indexes in Singapore and South Korea both gained 0.6 percent. Futures on the S&P 500 Index rose 0.1 percent, following last session’s 0.2 percent advance in the underlying benchmark.

“I’m not looking for anything spectacular in trading today,” Michael McCarthy, chief markets strategist in Sydney at CMC Markets, said by phone. “I expect we would be mildly positive to flat across the region.”

Bonds

New Zealand 10-year notes led a retreat in Asian bonds, with yields increasing five basis points, or 0.05 percentage point, to 3.13 percent. Rates on similar-maturity Australian notes rose three basis points to 2.70 percent.

With Japan closed for Labor Thanksgiving Day, trading in Treasuries was delayed until the European open. Ten-year U.S. yields were little changed on Tuesday at 2.31 percent. Yields have jumped about 26 basis points since Trump’s election victory.

Currencies

The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, was little changed after climbing 4 percent since the election.

“A December Fed funds 25 basis-point rate hike is fully priced in,” said Elias Haddad, a senior currency strategist at Commonwealth Bank of Australia in Sydney. “The dollar will continue to be driven by the pace of the Fed’s tightening cycle beyond December.”

Malaysia’s ringgit fell 0.4 percent against the dollar, heading for the longest losing streak since December 2013. All 19 economists surveyed by Bloomberg predict Bank Negara Malaysia will hold its overnight policy rate at 3 percent on Wednesday, after surprising the market with a reduction in July. The central bank has shifted focus to supporting the ringgit as expectations of a Fed rate increase spur capital outflows.

Commodities

Brent crude was little changed at $49.13 a barrel as West Texas Intermediate slipped 0.1 percent to $48.

While Libya’s OPEC governor Mohamed Oun said talks Tuesday in Vienna ended with a consensus, the meeting didn’t resolve whether Iraq and Iran will join any output cuts proposed by major global oil producers and deferred the matter to a meeting scheduled for Nov. 30, two delegates said. U.S. crude stockpiles fell by 1.28 million barrels last week, the industry-funded American Petroleum Institute was said to have reported Tuesday, ahead of government data.

Copper for three-month delivery rose 0.2 percent to $5,622 a metric ton on the London Metal Exchange, while most other industrial metals were little changed.

Add comment